[ad_1]

Skift Take

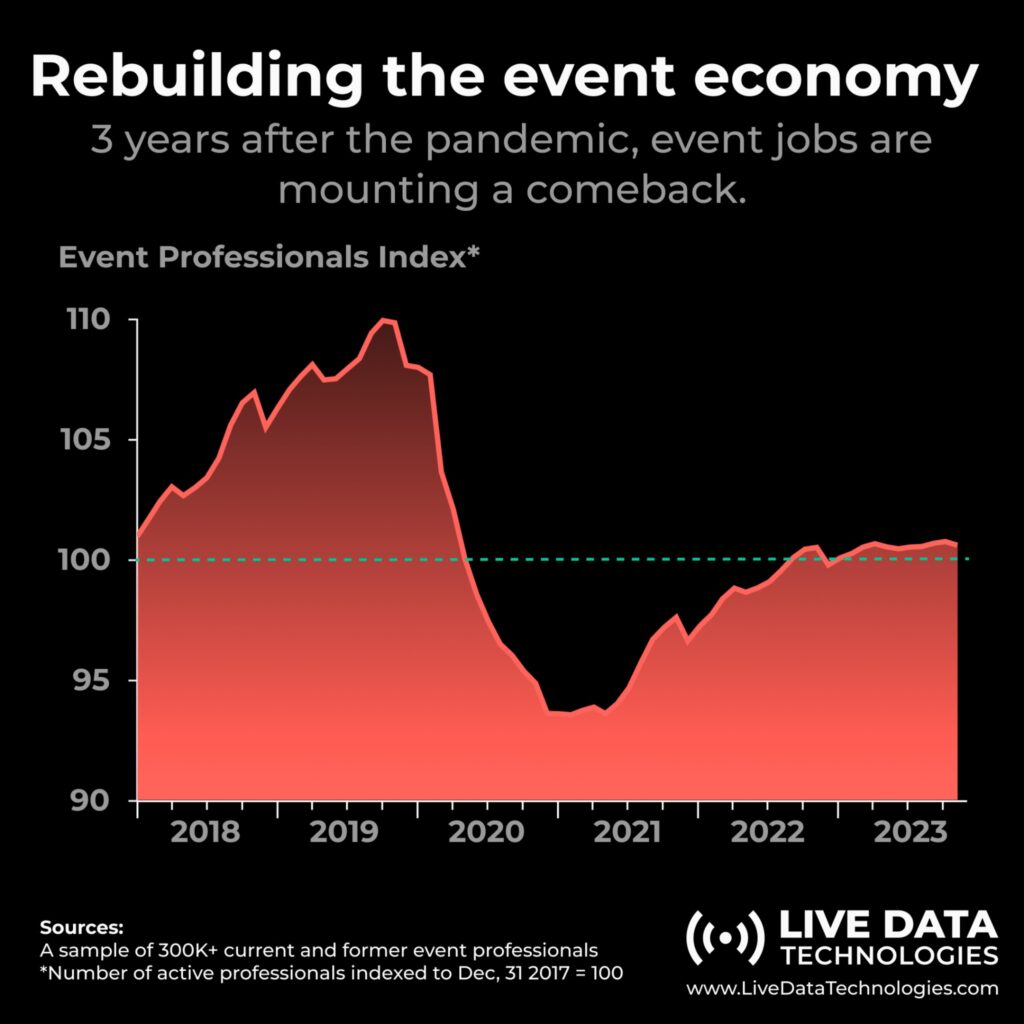

New data suggests a return to pre-pandemic event job level is near. With two-thirds of positions being filled by event-industry newcomers, service levels may yet take some time to fully recover.

The latest real-time job change data from Live Data Technologies shows event jobs are growing steadily and have reached above the level at the start of 2018. The same data suggests event jobs are still up to 10% lower than the pre-pandemic peak.

“I was curious how jobs in the events industry were rebounding post-COVID, and that led me to some of the job change events for this cohort,” said Director of Growth at Live Data Technologies Jason Saltzman. What’s being measured is a sample of people that we could verify working in events, whether that’s an event marketer or someone working at an events company,” he explained.

The company’s findings come from a database of 88 million white-collar workers and tracking 300,000 of those individuals who are current or former event professionals. The data collected represents event professionals within every category, including those working for events companies internally and externally. It uses search engine results page (SERP) analysis to examine a person’s public digital presence to verify their employment status. The process involves engineering search engine results to confirm current job roles with updates occuring every 10 to 14 days.

“The data shows that these jobs are coming back,” said Saltzman.

The Big Picture

According to data published in February by the U.S. Bureau of Labor Statistics, the U.S. job market saw growth in specific industries. The job gains happened in health care, government, food service, bars, social assistance, transportation, and warehousing.

While these industries bolstered their ranks heading into 2024, unemployment across the country rose by 0.2% to 3.9% compared to 3.6% during that time last year, representing 6.5 million unemployed.

The Industry-Specific Recovery

Marriott and Encore, two companies that have experienced massive exits since 2020, reported the highest post-COVID hires.

“It’s a sign that people are looking for these in-person events, companies are investing in these in-person events, and when we start to think about what the future of work will look like and how the future of business will happen – events will continue to be a part of that.”

According to Saltzman, the layoffs during the pandemic were a temporary blip. He added that the current data is evidence of companies’ normal homeostasis in investing in events that yield a return.

Newcomers in Majority

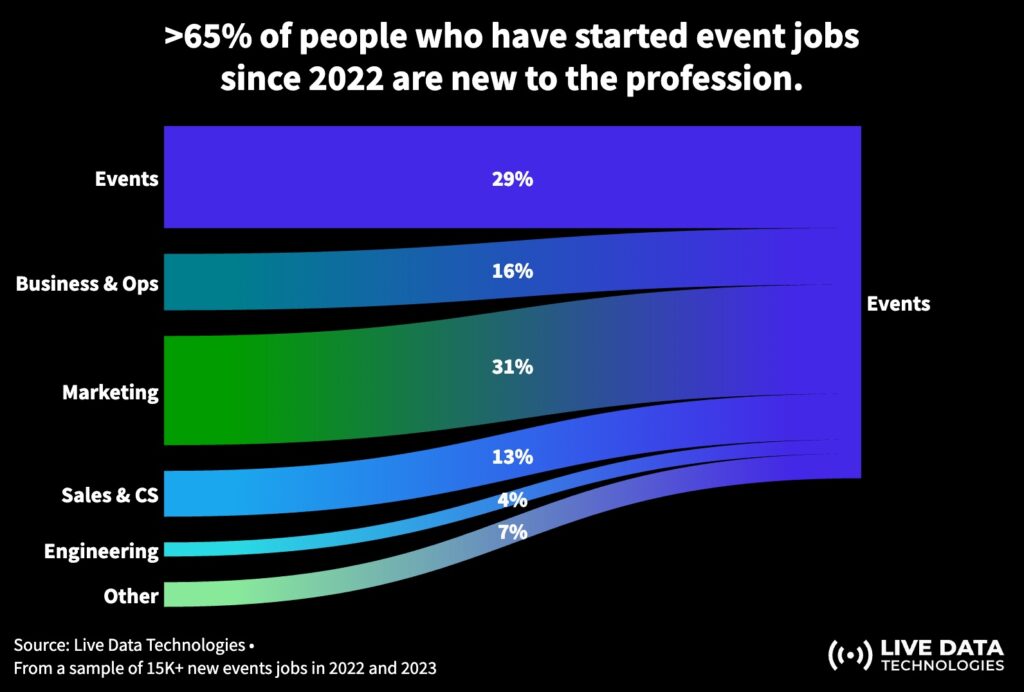

The data indicates that roughly two-thirds (10,985) of the 15,427 individuals who started jobs following the pandemic were new to the events industry.

The data shows that the vast majority of people now working in events came from marketing roles in other industries (31%) and business ops (16%), according to a sample of over 15,000 event jobs added in 2022 and 2023. A smaller influx of new event jobs went to people coming from sales and customer service (13%), engineering (4%) and from a miscellaneous category labeled “other” (7%). Workers make a transition into events because of layoffs in other industries.

“These people may be looking to pivot into something that is at least more stable,” he said. “It’s harder to replace someone who runs an event with an AI tool,” he said, noting that was one example of how event jobs offer an added layer of job security, making them an attractive option.

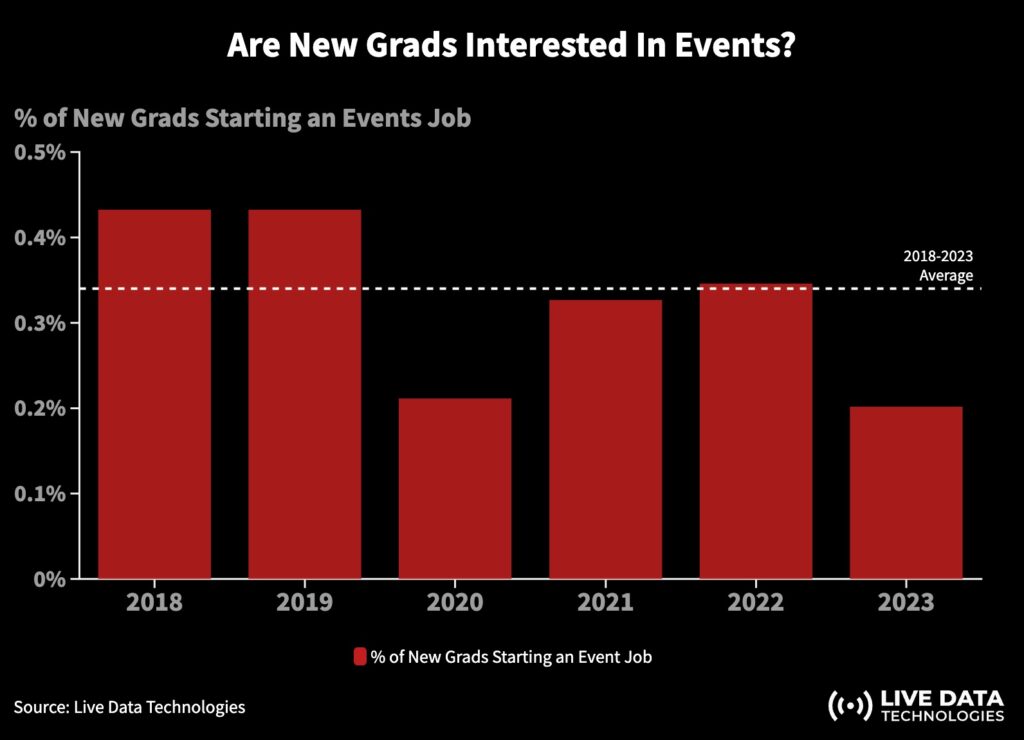

More worryingly, the data shows fewer recent graduates are looking for employment in events. New graduates have entered the industry at the lowest rate (0.21%) since 2018, when the data was first collected.

According to Saltzman, this is partly because event companies in a phase of rebuilding their workforce want experienced candidates familiar with navigating in-person events.

Related

[ad_2]

Source link