Being a freelancer is all about the hustle, saving money, and getting paid. As an established or even a new freelancer, it is important to offer the most convenient payment methods to your customer.

In today’s day and age, nothing should be complicated, especially payment methods.

Paypal is currently one of the most popular ways to send and receive payments. It is a quick way to invoice and collect payment from a customer. For a while, it was one of the few options that allowed for international payments, so it was heavily used in the market.

Get Weekly Freelance Gigs via Email

Enter your freelancing address and we’ll send you a FREE curated list of freelance jobs in your top category every week.

Paypal, however, does have its downsides. For example, it is not available in every country and it charges fees on every payment made, which can quickly add up or cut into your profits if that fee is not being passed to the customer. It also does not offer any options to send proposals and track projects in real-time as it is limited to just sending and receiving payments.

Thankfully, technology has continued to advance and more methods to collect payment and state-of-the-art freelancing tools are available. Listed below are 7 Paypal Alternatives for Freelancers to Collect Payments.

#1 Google Pay

Android Pay and Google Wallet joined forces in 2018 and became Google Pay. Google Pay is a good payment option as it charges no fees in most of its transactions. An added benefit is that Google Pay can be used on a mobile device, which would allow the user to not have to carry their cards everywhere.

Google Pay is easy to set up and start using, and it has a very high level of security. All payment details and other information are stored on Google’s secure servers, so you may rest assured your banking information is kept safe.

The downside of Google Pay is that it is not always compatible with all mobile devices and is not readily accepted in all locations so you may be limited in whom you can send money to or receive money from. Google Pay also only offers services for making and receiving payments, so it has limited use to freelancers.

#2 Plutio

Plutio offers an extensive platform to meet all the business needs of freelancers. For a nominal fee, you may create proposals, send contracts, manage tasks, track time and get paid.

For freelancers, this is a great tracking program as it allows you to see how much time you spent on a project and evaluate whether your current fees are what you need to be. You might realize you spent more time on a project than another if you are using their tracking system, which will, in turn, allow you to charge your customers more or less depending on the scope and past outcomes.

If you are new to sending proposals, contracts or invoices, you should rest assured because Plutio has several built-in templates for you to work off to create your own, unique documents.

To receive payments, all you need to do is create a quick invoice and send it to your customer. Plutio partners with several third-party apps such as Square, Stripe and Paypal so there is a wide array of payment options for the customer.

Accessibility is the name of the game, and that is exactly what Plutio offers.

#3 Quickbooks Payments

QuickBooks is an integrative software that offers methods for income tracking, estimates, customer invoicing, among other things. It has a relatively easy-to-use interface so you may quickly learn how to use the system. It also offers good accounting reports which are important for analyzing the current financials of the company.

It can, however, be a little more complex to use and it is definitely on the more expensive side of programs. Quickbooks also lacks invoice design tools, so you are limited in what you may send to customers and their data is not always backed up, so you could potentially lose important information about your freelance work.

#4 Stripe

Stripe is a fully integrated suite of payment products for businesses. It offers online and in-person retailers, subscriptions businesses, software platforms, and marketplaces among other options.

It helps companies avoid fraud, send invoices, issue virtual and physical cards, get financing, manage business expenditures, and many other options.

Stripe is another convenient way for freelancers to send invoices and receive payments from their customers. Stripe does not have monthly fees, however, it charges on the percentage of each transaction, which can accrue pretty quickly depending on your revenue.

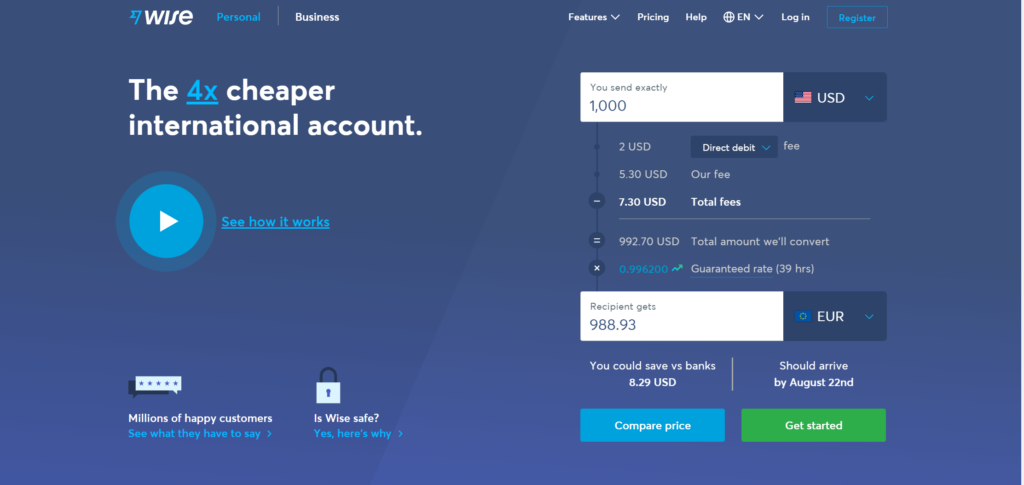

#5 Wise

Wise is essentially an electronic account option for sending and receiving payments. Wise does offer the option to make and receive payments through international transactions.

If you are sending a payment to Australia for example, all you need to do is input the USD amount that you would like to pay, and it will automatically show the conversion to AUD. This is an easy way to ensure you are sending the appropriate amounts.

Wise does not have monthly fees, but like Stripe it charges per transaction. Wise offers international payment options, but only in the following currencies: AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD. For a monthly fee, Wise also offers the option to receive account details in the same 10 currencies.

#6 Xoom

Like Wise, Xoom is also an electronic account option. It allows users to deposit amounts directly into bank accounts, send to debit cards, send cash for pickup and cash directly delivered to the client’s door if needed.

Xoom is available in 160 countries so it does reach many, but not all, places.

The recipient does not need to have the Xoom app to receive money, so that is a bonus. It also has low transfer minimums, so it is possible to send lower amounts of money at a time.

A few downsides are that fees are generally higher than the competitor’s fees, the delivery may take longer to some destinations and the exchange rate may be on the lower end of the market.

#7 Zelle

Zelle is a payment option that is possible through the Zelle App or eligible online banking apps.

Zelle is a free transfer option, so it is a safe and free way to receive U.S. payments for freelancing services with Visa and Mastercard. It is available on many bank account apps, and you do not need the bank account number to send or receive money through the app.

Zelle does have payment limits and does not offer fraud protection, so you need to be certain that the person receiving or sending this payment is a reliable source.

What Should Freelancers Keep In Mind When Choosing A Payment App

There are many different methods to receive payment from customers. In a way, it might feel overwhelming to know which one to choose. The truth is that each freelancer must evaluate what their business needs are and how it fits into freelancing needs.

If you are a freelancer who is new to the business, perhaps you might want to start out with something simple.

However, if you know your business will grow quickly, it is important to try and make the right choice at the beginning so you may continuously track the growth of your business.

Attorney Percy Martinez from Percy Martinez P.A. advises that you should investigate the safety of any app you use to receive payments thoroughly. Safety is key when decided which app to use.

Payment Options Should Be Practical

As a freelancer, you probably work a flex schedule and more hours than the traditional 9 to 5 jobs. Every day is an adventure and filled with the possibility of new opportunities.

It is important, however, to choose a payment app that will not take up a lot of your time. Whichever option you choose should be hassle-free so you may send an invoice, receive payment and quickly move on to the next project.

Nothing is worse than losing what could have been billable hours to a customer because you have difficulties with the payment app you chose.

Therefore, new as well as experienced freelancers should take a good look at payment apps and their features before committing to one.

Payment Options Should Be Unified

Although having several different payment options and, consequently, options may seem like a good option, the truth is that will make the business side of things more confusing.

If you use 4 or 5 different methods to collect payments, when the end-of-the-month close-out arrives, you will have to go into each app and track invoices and payments received to balance out the end of the month.

If you find that you are spending entirely too much time tracking down payments to ensure that you have received every payment request you sent out, you are cutting into your time that could be used going after new opportunities.

A good option in this scenario is to find an app that will allow you to offer more than one payment method to clients. The best thing you can do in your freelancing journey is to simplify processes.

Having just one payment option will be beneficial to giving the clients flexibility in how they pay but also ensure that how you receive payments in a way that is convenient to you.

As a freelancer, you always want to portray professionalism in every aspect of the business. Things such as professional e-mail sign-offs, branded invoicing and proposals, digital business cards, well-placed QR codes on print materials, and unified payment options are important to showing professionalism.

Payment Apps Can Be More Than Just Receiving Money

When you first start freelancing, having a payment app that only allows you to send and receive money may seem like a good idea. And in truth, for a while, it may be a good idea.

However, what will happen when you grow your business and suddenly it seems like you are making money, but you are not really sure how much that is?

Some of the payment apps listed above offer more services than just the sending and receiving of money. Plutio, for example, allows you to track projects and your current status on them.

If you are a freelance graphic designer working on a design project for a customer, you may send them a contract, or invoice, and monitor which phase of the project you are on, along with how much time you have spent on the project.

If you bill the customer by the hour, this is an easy way to know how much to invoice them. If you have charged the customer by the overall project and not the hours, knowing how many hours you did spend on the project will allow you to bill the next project more accurately and efficiently since you have the actual data of how much time you spent.

Narrowing down on the right payment app is crucial if you want to save yourself time and appear professional. In the long run, the monthly fee you spend on a good app will pay you back tenfold.

Payment Apps Should Be Safe

As a freelancer and business owner, you know how important it is to be protective of your assets. Having a lawyer you can call and making sure you have liability insurance properly set up are just two examples of how you may keep your business and work safely.

Another important way is to ensure that whatever payment app you choose also has secure servers where the information is stored. You will want to rest assured that any stored data is safe within the app so you will not need to worry about it.

Customer Service Is Essential

Every now and then, you may have an issue with the app that you choose. Regardless of the choice, you will probably have to contact customer service at some point and time.

Before you commit to a payment app, take into consideration what the app’s customer service is like. Is it all automated where it is hard to reach someone? Or are you actually able to directly chat or send an e-mail to their customer service for assistance? Knowing whatever issue you may have will be resolved quickly and efficiently is primordial to choosing a payment app.

Analyze Which App Is Best for Your Freelancing Needs

Every app is going to have pros and cons. Each freelancer must be able to analyze their current needs and decide which payment app is best for their business. Being able to start off with the right app, or knowing when you should be switching to another app is essential to a successful freelance business.

Keep the conversation going…

Over 10,000 of us are having daily conversations over in our free Facebook group and we’d love to see you there. Join us!